OUR COMPANY

Patrimundi 1869 is a Luxembourg-based independent asset management company regulated by the Commission de Surveillance du Secteur Financier Luxembourgeois (CSSF). We advise our clients on how to manage their assets and structure their wealth by having them capitalise on the advantages that Luxembourg has to offer as a financial centre.

Philarmonie de Luxembourg

The Grand Duchy of Luxembourg enjoys a solid reputation of long standing among international investors, thanks to its political and regulatory stability. Its role and importance in Private Banking are constantly growing.

Our articles of association enable us to manage the assets of our clients in Luxembourg and abroad.

Patrimundi 1869 is held fully (100%) by its founding and managing partners:

Alain Crefcoeur

With over thirty years of experience in Private Banking, Alain Crefcoeur embarked on his career in Brussels before moving to Luxembourg in 1988. After several years in a renowned Swiss private bank, he left the Grand Duchy for Geneva and then Basel to head an independent management company. Back in Luxembourg since 2011, he is now fully dedicated to the development of Patrimundi 1869.

Hervé Coque

After a 20-year career in the banking sector as Asset Management Consultant at Credit Agricole, Hervé moved to Luxembourg in 2006 to take up duties as business manager, then managing director of a French management company.

OUR SERVICES

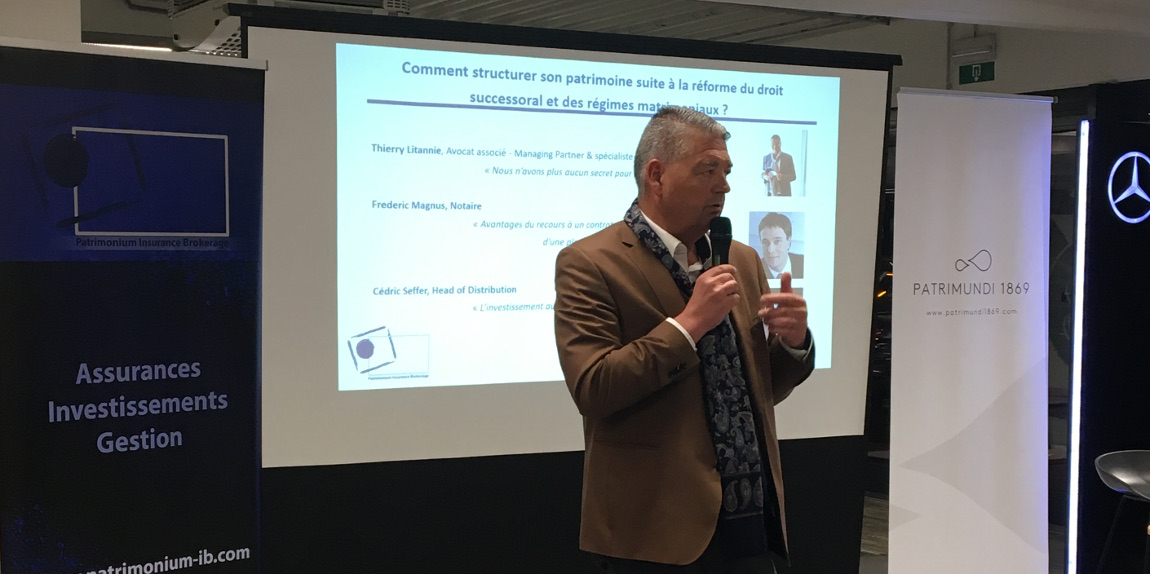

We have been providing advice and guidance to our clients as a favoured partner through the years on how to manage their assets and structure their financial wealth (inheritance, taxation, transfer of business, etc.). In a constantly changing economic and regulatory context, we call on the skills of partners (lawyers, trusts, tax experts, etc.) as and when warranted to provide appropriate, tailor-made solutions to our clients. Advisory in Patrimonial Structuring

Patrimundi 1869 provides a discretionary asset management service to its private clients. As independent asset managers, we proceed to tackle the assignments entrusted to us by our clients. Their assets are deposited in their name, in the name of their companies or their life insurance contracts with first rate custodian banks in Luxembourg and any other country of their choice. We also advise family offices and companies on their strategies and investment choices.Discretionary Asset Management

We engage in global asset management strategy, without restriction in terms of asset categories or geographic scope.Asset Allocation

We have acquired recognised expertise of long standing in fund selection and allocation. Relying on a strategy charted by the investment committee, we proceed to identify the most talented fund managers in their field and to select complementary products in terms of style, exposure and performance drivers.

Our close ties with fund management companies translate into regular contacts, an in-depth knowledge of each product, and access without entry fee for our client.

We are also active in the Private Equity and real estate sectors.

OUR PHILOSOPHY

A relationship of trust

Due to the very nature of the service we provide, the relationship we establish with our clients is bound to continue over many years.

Based on confidentiality and regular contacts, such a relationship of trust is critical when it comes to long-term projects and investments. This proximity is a real winning asset compared to major banking institutions.

Tailored asset management

A structure on a human scale and close ties with our clients enable us to provide customised management for each portfolio.

Once we have defined the main lines of the investment strategy in committee, the decisions are implemented in a personalised manner, according to the risk profile and specific traits of each client.

Our independence moreover stands guarantee for unencumbered investment decisions.

Tailored solutions

The development of our societies entails an enhanced diversity of tax and inheritance issues faced by our clients (children residing abroad, change of tax residence, divorces, etc.).

As each situation is quite often unique, it requires a precise assessment and bespoke solutions. Our expertise and network of first-rate partners enable us to take action on most financial issues such as asset structuring, asset management, search for funding, etc.

Capital preservation and long-term vision

Clients who have put their trust in us for many years are in search of a reasonable growth for their capital whilst avoiding extreme volatility.

In addition to a few tactical adjustments, we believe that allocation must reflect a long-term strategy.

Whereas important decisions can be taken to adapt and protect portfolios against major risks, conviction management and a selection of well-performing funds are the best ways to generate performance in the long run and to get calmly through the volatility phases that punctuate the short-term markets.

The stock market is a device for transferring money from the impatient to the patient.

Warren Buffett

CONTACT US

PATRIMUNDI 1869 S.A.

20 boulevard Emmanuel Servais

L–2535 Luxembourg

Telephone : (+352) 26 26 77

Fax : (+352) 26 26 77 666

E-mail : info@patrimundi1869.com